tucson sales tax calculator

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. You can find more tax rates.

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Tucson is located within Pima County ArizonaWithin.

. Multiply the vehicle price. South Tucson in Arizona has a tax rate of 10 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in South Tucson totaling 44. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The December 2020 total local sales tax rate was also 8700. This is the total of state county and city sales tax rates.

This includes the rates on the state county city and special levels. The Arizona sales tax rate is currently 56. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax. As we all know there are different sales tax rates from state to city to your area and everything. Method to calculate Old Tucson sales tax in 2022.

Name A - Z Sponsored Links. This includes the rates on the state county city and special levels. Method to calculate Tucson Estates sales tax in 2022.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

The average cumulative sales tax rate in Tucson Arizona is 801. Tucson in Arizona has a tax rate of 86 for 2023 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Price of Accessories Additions Trade-In Value.

Method to calculate Tucson Meadows Mobile Home Park sales tax in 2022. The average cumulative sales tax rate in Pima County Arizona is 814 with a range that spans from 61 to 111. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

Method to calculate South Tucson sales tax in 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Sales Tax Calculator in Tucson AZ.

The current total local sales tax rate in Tucson AZ is 8700. Method to calculate Corona de Tucson sales tax in 2021. Tucson Sales Tax Rates for 2023.

Arizona has a 56 statewide sales tax rate but also. Method to calculate Tucson sales tax in 2022. How to Calculate Arizona Sales Tax on a Car.

Sales tax in Tucson Arizona is currently 86. Tax Paid Out of State. The minimum is 56.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

2022 Cola Adjustments Year End Tax Planning Phoenix Tucson Az

2022 Hyundai Tucson Hybrid Lease Payment Calculator U S News

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Quickbooks Online New Features And Improvements November 2019 Firm Of The Future

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

How To Use A California Car Sales Tax Calculator

Turbotax Online Software End User License Agreement Tax Year 2021

Rental Property Returns And Income Tax Calculator

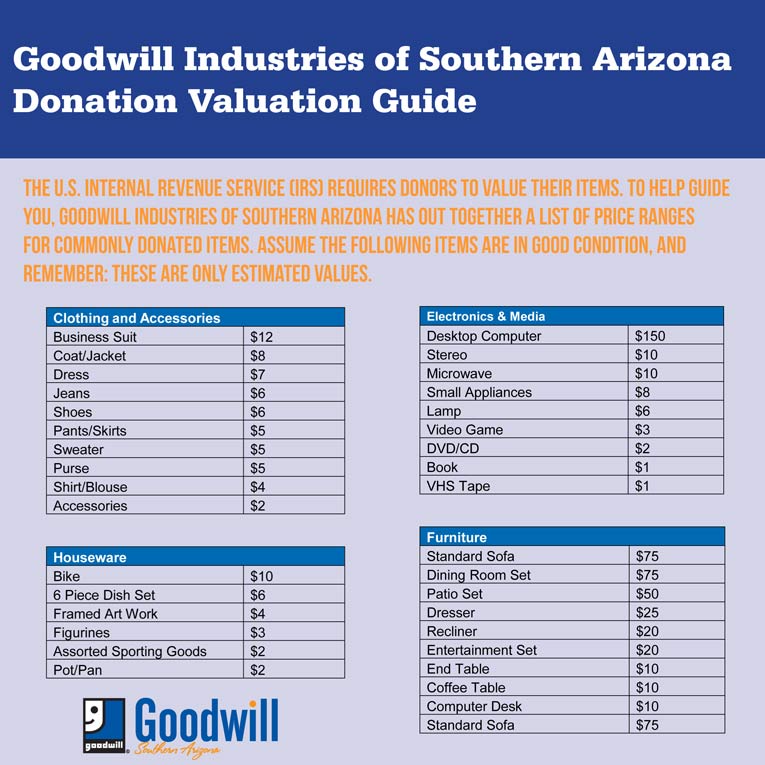

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona

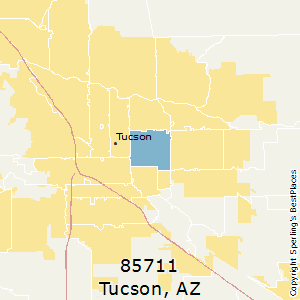

Best Places To Live In Tucson Zip 85711 Arizona

Arizona Sales Tax Small Business Guide Truic

Car Rental Taxes Reforming Rental Car Excise Taxes

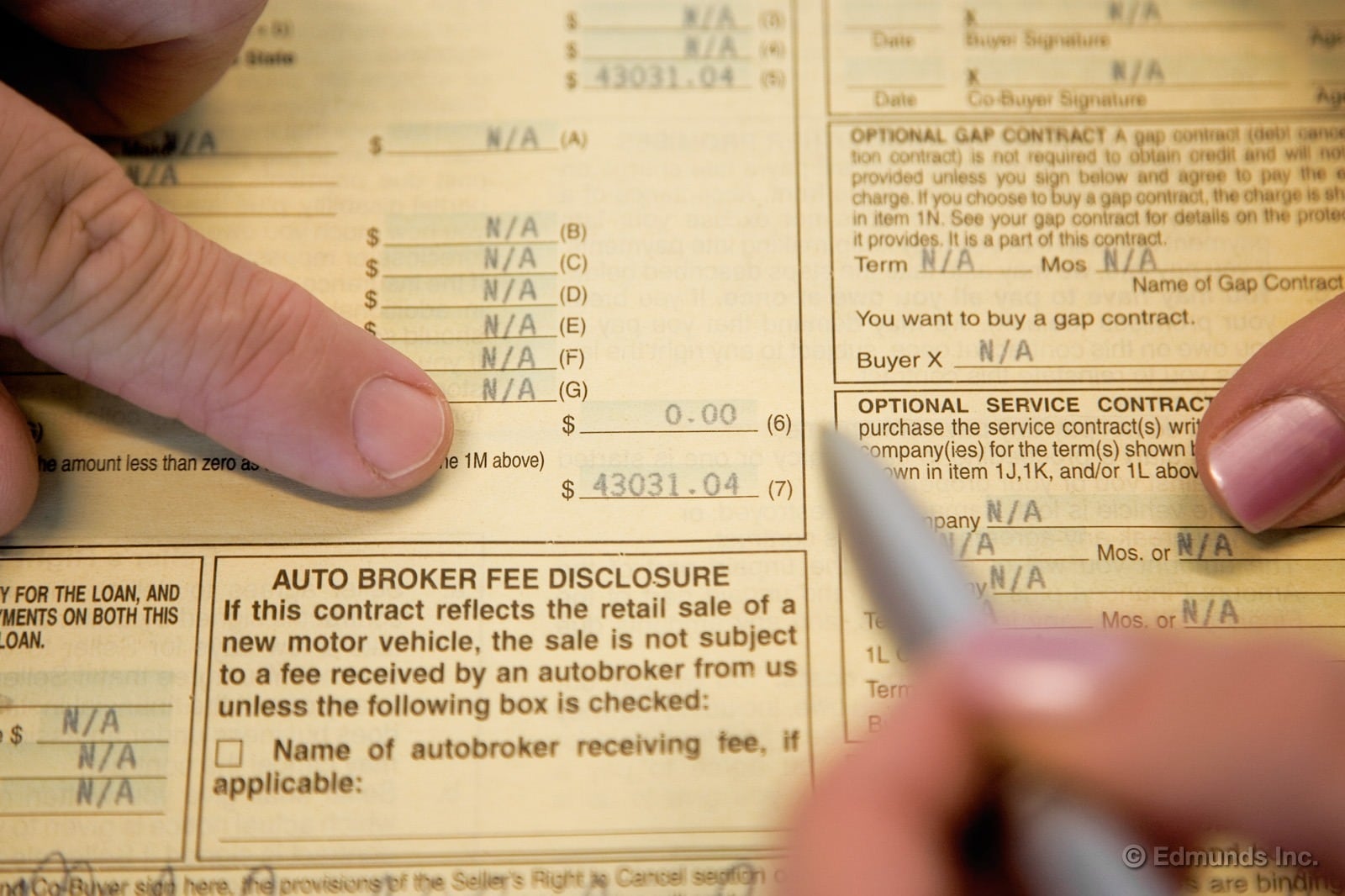

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable