wells fargo class action lawsuit payout

The settlement requires Wells Fargo to compensate eligible. 2 the 500 Additional Compensation payments to the Statutory Subclass Members.

Wells Fargo Jpmorgan Among Banks Sued Over Sba Virus Loans Bloomberg

Wells Fargo CIPA Settlement 2021 28 Million To Businesses Whose Calls Were Recorded Without Consent By Consider The Consumer on January 10 2022.

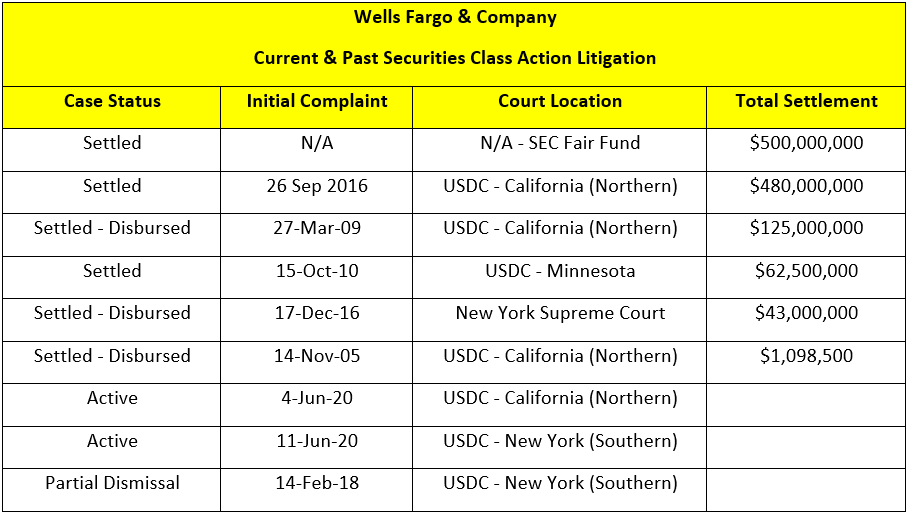

. Wells Fargo will pay 480 million to a group of the banks shareholders as part of a class action settlement for allegedly lying about the sales practices that led to the banks massive fake. Negotiations have been hard according to the customers requesting approval for the class action settlement. District Court judge in northern California approved another 142 million class-action settlement in late May for victims of Wells Fargos fake accounts scandal.

Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage. The company has agreed to pay 3 billion to resolve the claims. Under the terms of the settlement agreement Class Members will be automatically entered into the settlement and receive a share of 13575 million.

01 2021 Whos Eligible. As a result the bank was ordered to pay out more than 200 million to victims of overdrafts. Wells Fargo Settlement Call Recording Claims Class Action Lawsuit.

16 hours agoThe lawsuit estimates as many as 13000 potential participants in the class-action suit including all Black people in the US. Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. Nearly 36 million will be paid out to borrower attorney fees and 500000 will cover attorney expenses.

For the 394 million settlement Wells Fargo is estimated to pay 385 million and National Guard will cover the remaining 75million. If you paid for a CPI Policy and do not qualify for compensation under any of the above categories as part of the Settlement Allocation Plan you will receive a pro rata distribution under the Settlement Distribution Plan. Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute.

The court documents also claim that Wells Fargo knowingly rejected a large number of refinancing applications from Black homeowners back in 2020 at the height of the. The banks overdraft policy was found to be unconstitutional under federal law. The class action lawsuit was filed in San Francisco and further claimed that Wells Fargos business practices resulted in Black homeowners being forced into home foreclosure.

Wells Fargo will establish a settlement fund Settlement Fund totaling 4500000000 to pay. Feb 23 Reuters - Wells Fargo Co was hit with a proposed class action lawsuit on Wednesday accusing the bank of routinely requiring hourly. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for.

The final approval of a 28 million CIPA settlement agreement between Wells Fargo and its customers has been. In 2020 the bank settled overtime pay claims by a nationwide class of nearly 9000 employees for 35 million. Wells Fargo will pay 500 million to end a class action lawsuit refunding US.

The bank estimates up to 35 million accounts were created between. 6375 million will be distributed proportionally to Settlement Class Members who do not receive payment under the Settlement Allocation Plan if they paid for a. Wells Fargo Settlement Call Recording Claims Claim Form.

And 4 any Service Awards to the Class. Reporting by Daniel Wiessner in New. Settlement Agreement Main Document Document 262-1 PDF Settlement Agreement Exhibit A - Definitions Document 262-2 PDF Settlement Agreement Exhibit B - Settlement Allocation Plan Document 262-3 PDF Settlement Agreement Exhibit C - Settlement Distribution Plan Document 262-4 PDF Class Action Complaint.

Welcome to the Informational Website for the Wells Fargo CPI Class Action Settlement. Class Action Settlements. Wells Fargo denied wrongdoing in both cases.

PDF Defendants are distributing at least 3935 million to Class Members pursuant to an Allocation Plan. The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. In the end the company was forced to reimburse overdraft victims 203 million in refunds.

The process is expected to take until early 2020 as there are hundreds of thousands of eligible class members to compensate. Wells Fargo CIPA Settlement Receives Final Approval. Wells Fargo Loan Modification Error Caused By Wells Fargos Negligence.

The settlement in the Wells Fargo unwanted auto insurance lawsuit has been preliminarily approved by the Court and the settlement checks are being mailed out to eligible customers. 1 the Approved Claims for GAP Refunds to the Non-Statutory Subclass Members. A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo.

3 the Fee and Expense Awards to Class Counsel approved by the Court. Wells Fargo has agreed to pay 2 million to end claims it did not properly pay its home mortgage consultants and other employees. The Class includes all businesses that received a phone call from a call center operated by International Payment Services LLC or one of its affiliates between March 7 2011 and May 7.

Wells Fargo will pay 3 million as part of a settlement resolving a class action lawsuit that claimed the bank mishandled bankruptcy credit reporting. The lawsuit also alleges that Wells Fargo knew of the error. The settlement includes 500 million in investors money.

Wells Fargo to Pay 2M to Settle Class Action Lawsuit over Wage Violations. The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle. The class action lawsuit we filed alleges that Wells Fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations.

Wells Fargo To Shell Out 110m To Settle Fake Accounts Lawsuit Cbs News

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Www Wellsfargocpisettlement Com Class Action Lawsuits Tech Company Logos Wells Fargo

Even More Predatory Actions On The Part Of Wells Fargo This Time It S Allegations Of Unauthorized Stealth Mortgage Modifications Wells Fargo Fargo Wellness

Wells Fargo Customers Won T Be Able To Sue The Bank Over Fake Accounts The Denver Post

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Four Settlement Checks In The Mail Top Class Actions

Wells Fargo To Pay 7 8 Million To Workers To Settle Hiring Discrimination Charges

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Wells Fargo Mortgage Fee Class Action Settlement Top Class Actions

Wells Fargo Settles Phony Account Securities Suit For 480 Million Wells Fargo Sales Strategy Creation Activities

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Us Bank Wells Fargo Agrees 110m Lawsuit Settlement Bbc News

Wells Fargo Agrees To Settle Auto Insurance Suit For 386 Million The New York Times

Wells Fargo Home Loan Class Action Settlement Top Class Actions